how does an open end loan work

The borrower can choose the amount he wants to take to purchase the property. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Open End Mortgage Loan What Is It And How It Works

How Does An Open-End Loan Work.

. An open-end mortgage allows a high mortgage loan amount but compared to the interest rate of a traditional mortgage which is noticeably lower than an open-end mortgages. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. This means that a lender gives you a specific amount of money and expects to have both the interest and principal repaid in a set amount of.

If you are familiar with a line of credit you will easily understand. 4 hours agoLets say you were approved for an open-end mortgage in the amount of 500000 and buy a home for 440000. Heres all you need to know about an open-end mortgage.

Advantages of Open Credit. Open-end credit is a revolving credit product while closed-end credit is a nonrevolving lending product. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back.

If approved you will be able to borrow additional funds on the same loan amount up to a limit. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. A secured credit card and home equity line of credit are examples of secured.

Youll begin repaying principal and interest on the 440000. How Does An Open End Loan Work. An open-end mortgage allows you to tap into the equity in your home and use the funds as necessary.

Open-end loans provide the borrower with the highest amount of loan they can obtain in a given period. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments. Although an end loan can have interest-only or other.

An open loan is a type of loan a bank or financial institution offers a person or company giving them the ability to use up to a certain amount of credit as needed. Thats the core difference between these distinct forms of credit. An open-end mortgage is also sometimes called a home improvement loan.

Car loans are closed-end loans. Open-end mortgage loans can help you close a property deal in no time. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed.

Skip primary navigation links. It remains open and it. Unsecured open-end credit lines generally have higher interest rates and.

Open-end lines of credit and loans do have their drawbacks. A closed-end loan is often an installment loan in which the loan is issued for a. A permanent long-term loan used to pay off a short-term construction loan or other form of interim financing.

Read this article to learn the ins and outs of this loan. Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a. An open-end mortgage allows you to access your home equity and use the funds as necessary.

Disadvantages of Open-End Credit Products. A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral.

How To Get A Personal Loan With Bad Credit Bankrate

What Is A Reverse Mortgage Money Money

How Does A Small Business Line Of Credit Work

What Is An Open End Mortgage The Real Estate Decision

10 Questions To Ask Before Applying For A Personal Loan

How Do Credit Cards Work A Beginner S Guide The Ascent

Using A Personal Loan To Pay Off Credit Card Debt Forbes Advisor

What Are Interest Rates How Does Interest Work Credit Org

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

Personal Loans Vs Credit Cards What S The Difference

How Home Construction Loans Work Lendingtree

Glossary Of Banking Terms And Phrases

Bank Of America Banking Credit Cards Loans And Merrill Investing

Interpretation Of Open End Loan In Real Estate

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Opsc On Twitter Doyouknow Sofi At Work Has Partnered W The Aoafordos And Opsc For The 50k Healthcare Heroes Sweepstakes Visit Https T Co I5bgmhqvmp Click The Put A Dent In Your Student Loan Link

How Payday Loans Work Interest Rates Fees And Costs

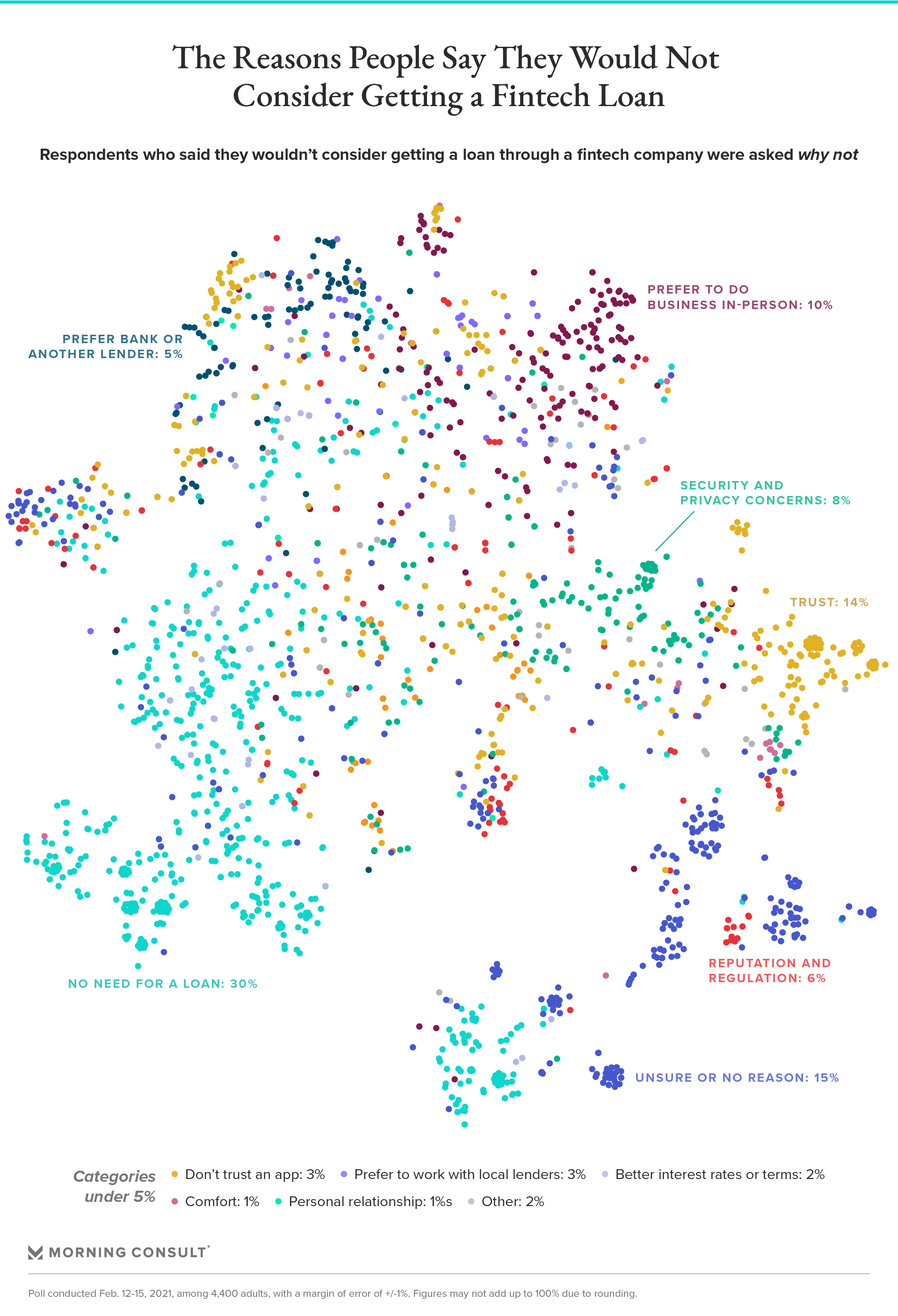

To Gauge The Future Of Lending We Asked People If They D Get A Fintech Loan